case study

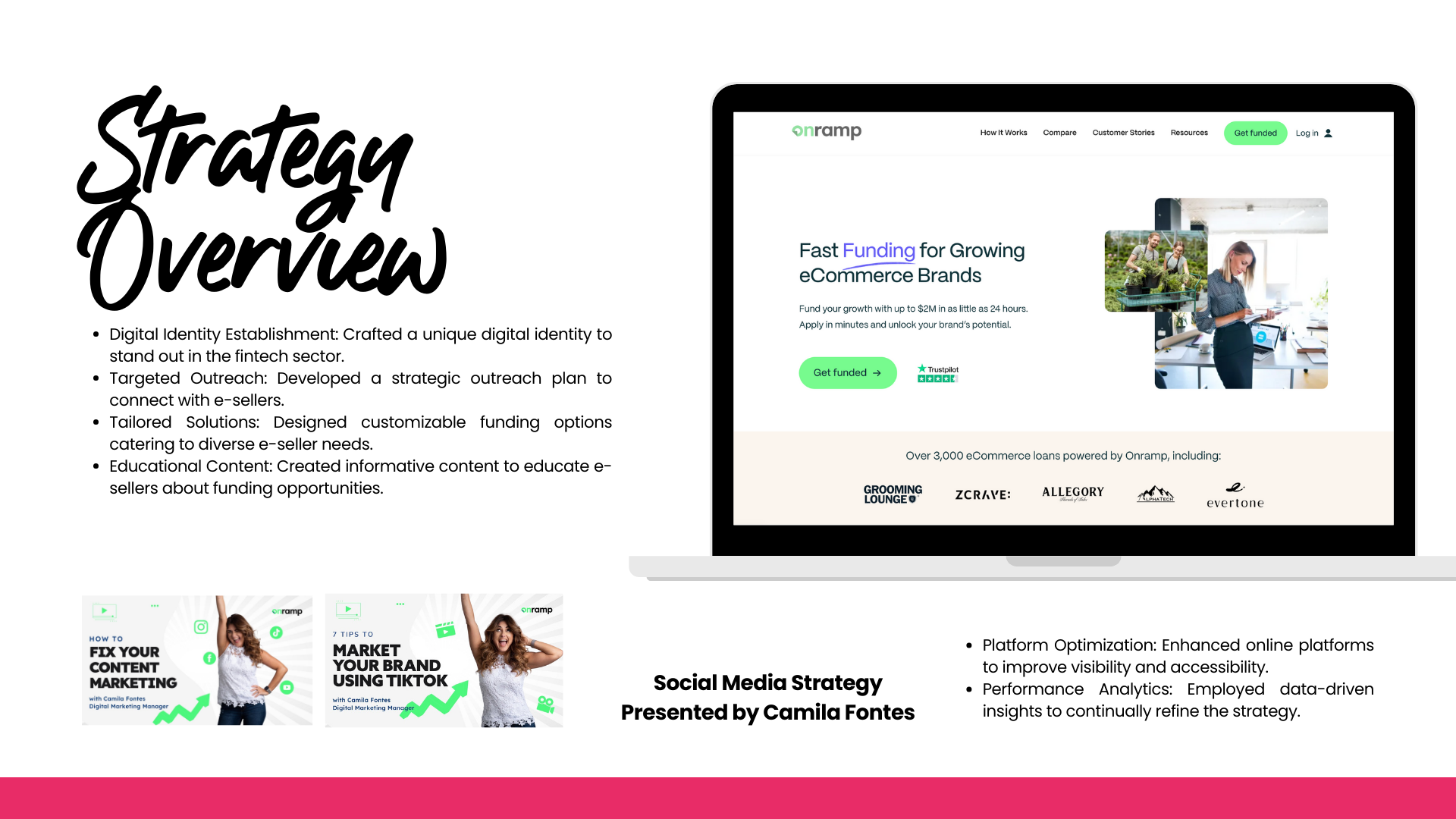

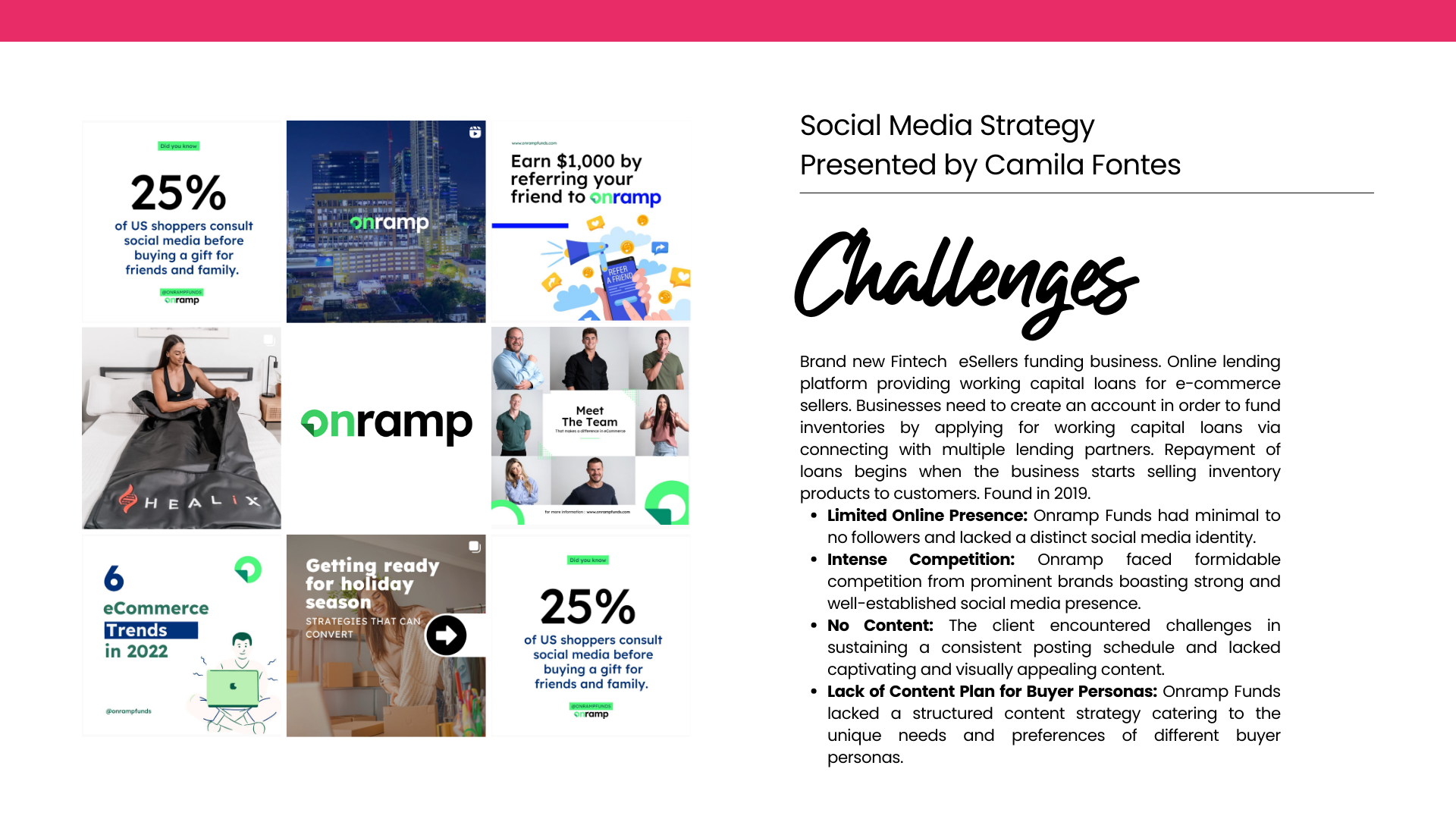

Online lending platform providing working capital loans for e-commerce sellers. Businesses need to create an account in order to fund inventories by applying for working capital loans via connecting with multiple lending partners. Repayment of loans begins when the business starts selling inventory products to customers. Found in 2019.

New Leads

0

+

Likes

0

k

Viral Content

0

%

Challenges

- Driving website traffic: Needed to increase website traffic and attract new Amazon and Shopify seller sign-ups.

- Improving key performance metrics: Sought to improve key performance metrics through effective social media strategies.

- Boosting brand awareness: Aimed to increase brand visibility and recognition among target audiences.

- Managing negative feedback: Needed to develop a strategy to mitigate the impact of negative feedback and protect the company’s reputation.

- Creating engaging content: Faced the challenge of creating compelling content that would drive traffic to the website and increase user engagement.

- Optimizing Facebook ads: Sought to improve the effectiveness of Facebook ad campaigns to maximize reach and engagement.

- Enhancing visual content quality: Aimed to improve the quality of visual content to better engage audiences.

- Elevating overall content quality: Needed to create high-quality, compelling content across all social media platforms.

- Boosting audience engagement: Sought to increase audience interaction and participation with social media content.

- Identifying new content opportunities: Aimed to stay ahead of social media trends and identify new opportunities for content creation and audience engagement.

Strategies

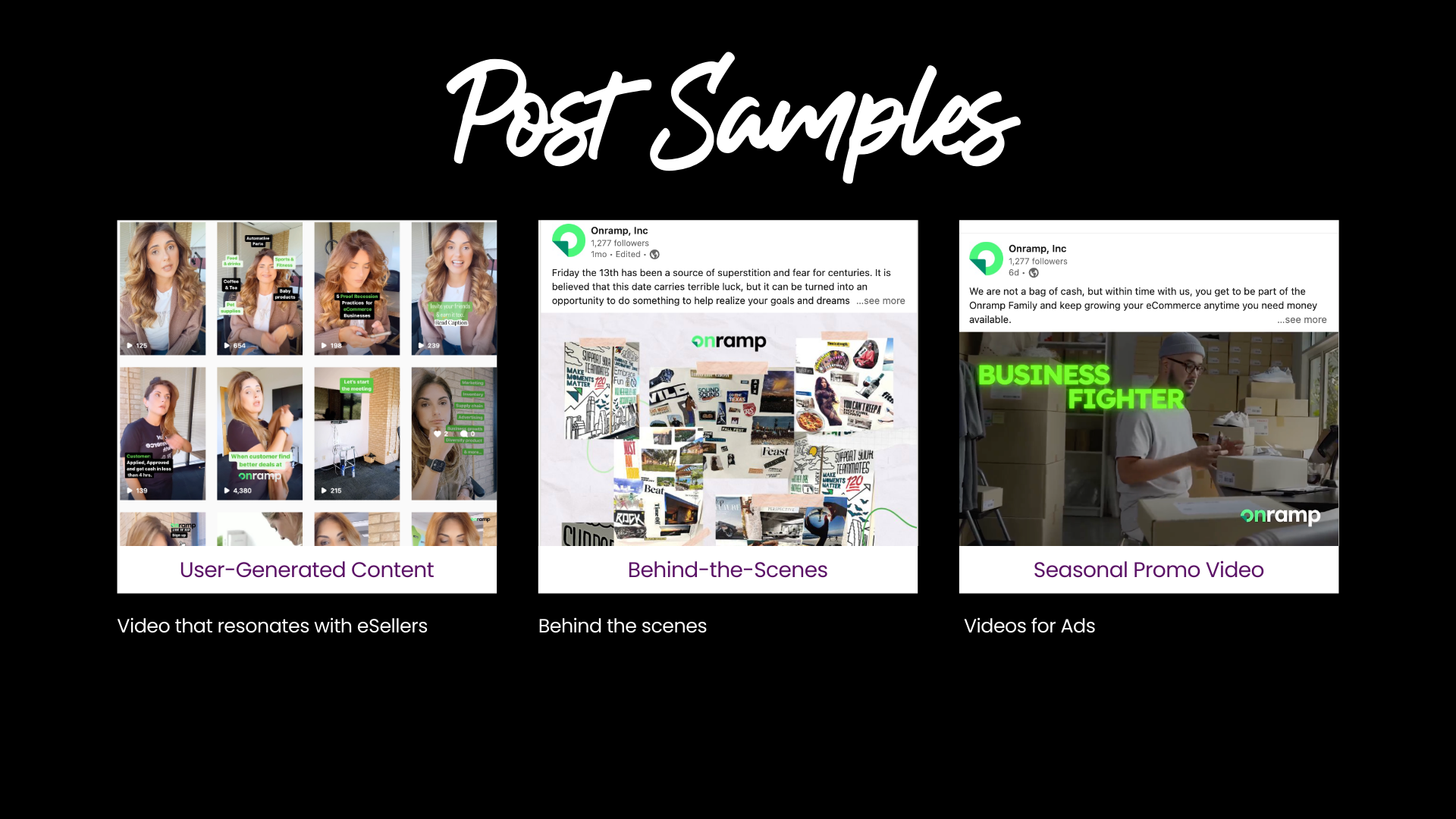

- Developed and executed comprehensive social media strategies across multiple platforms (Facebook, X (Twitter) your , Instagram, TikTok, Pinterest, YouTube, and LinkedIn) to enhance platform-specific engagement.

- Maintained consistent brand messaging across all social media platforms, supporting eCommerce sellers and community building.

- Stayed informed about the latest social media trends and platform updates to ensure cutting-edge strategies.

- Developed and managed detailed performance reports, ensuring strategic oversight and timely analysis.

- Tracked and analyzed social media metrics, providing actionable insights to improve performance.

Accomplishments

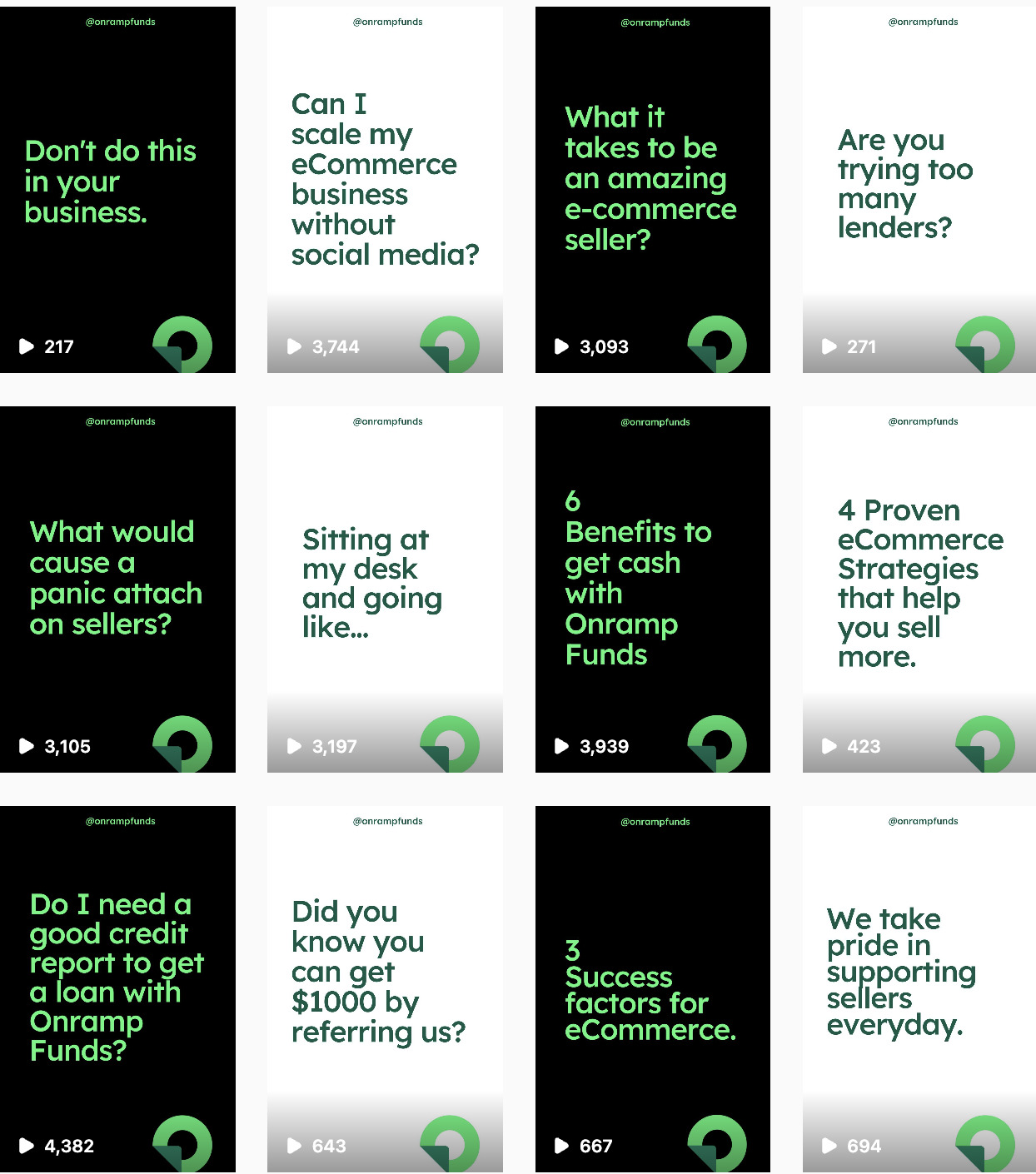

- Increased website traffic from Amazon and Shopify seller sign-ups by 30% by implementing a tailored social media calendar.

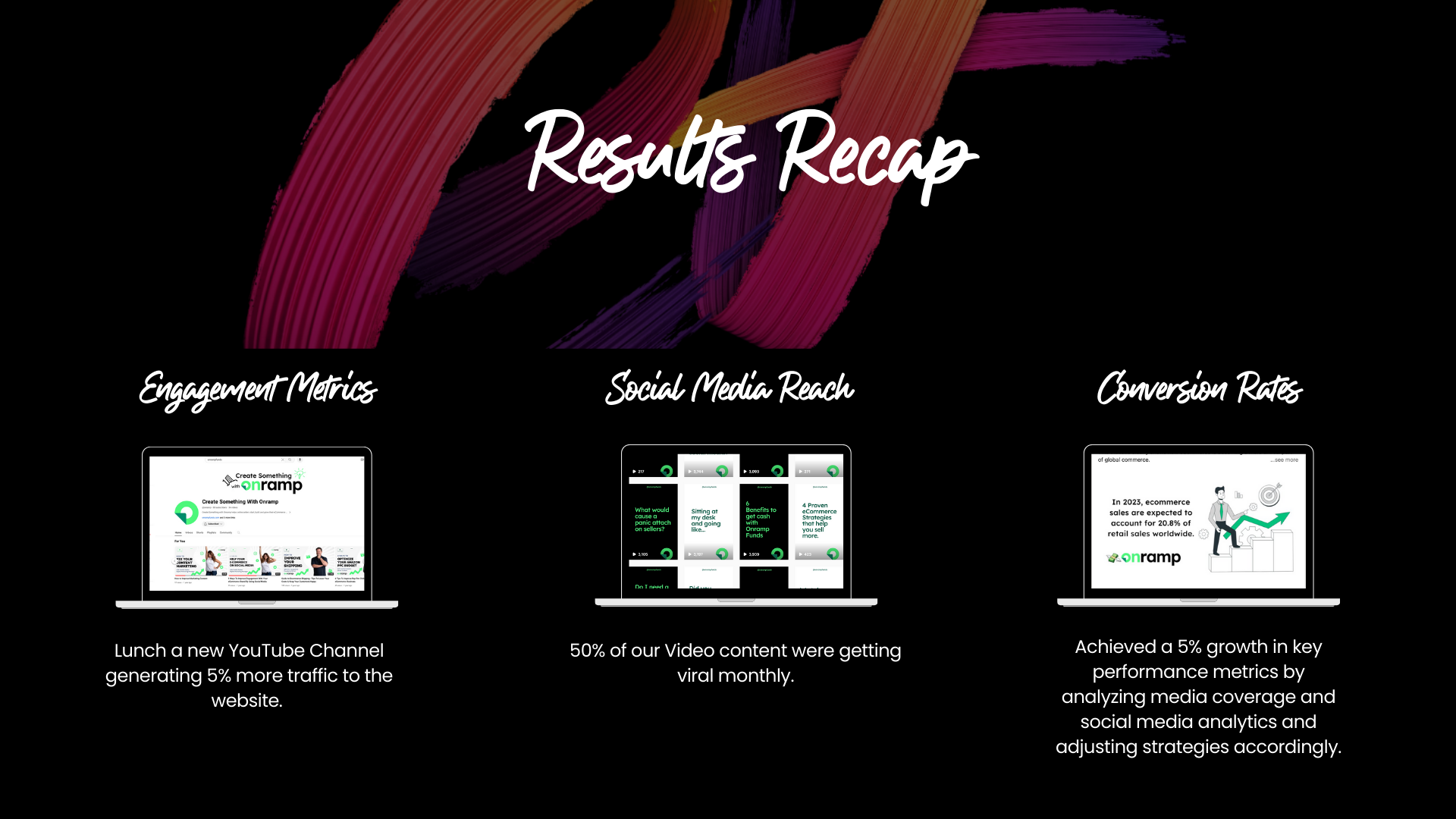

- Achieved a 5% growth in key performance metrics by analyzing media coverage and social media analytics and adjusting strategies accordingly.

- Boosted brand awareness by 17% by producing educational YouTube videos for sellers.

- Minimized the impact of negative feedback on the company’s reputation by developing and executing a social media crisis response plan.

- Significantly increased customer traffic to the website by creating engaging content strategies with compelling CTAs and videos.

- Boosted brand awareness and user engagement by managing and optimizing Facebook ads.

- Enhanced visual content quality by producing high-quality marketing videos using Canva and production company.

Results Recap

- Driving website traffic: Faced the challenge of increasing website traffic from Amazon and Shopify seller sign-ups, which was addressed by implementing a tailored social media calendar resulting in a 30% increase.

- Improving key performance metrics: Addressed the need to improve key performance metrics by 5% by analyzing media coverage and social media analytics, and adjusting strategies accordingly.

- Boosting brand awareness: Tackled the challenge of boosting brand awareness by 17% by producing educational YouTube videos for sellers.

Final Thought

At Onramp Funds, I spearheaded impactful social media strategies that significantly boosted brand awareness, increased website traffic, and drove engagement across multiple platforms, contributing to the successful positioning of Onramp Funds within the competitive fintech funding landscape. Over the course of ten months, our comprehensive approach, focused on tailored solutions, educational content, and strategic digital outreach, achieved significant growth in e-seller engagement and brand recognition. This contributed to the company’s long-term success, even amidst ongoing changes and innovations, including a new website and business strategy in 2023 that maintained steady client retention.